wake county nc sales tax rate 2019

County rate 60 Fire District rate 1027 Combined Rate 7027 No vehicle fee is charged if the property is not in a municipality Property value divided by 100. Sales and Use Tax Rates Effective April 1 2019 NCDOR.

Wake County North Carolina Property Tax Rates 2020 Tax Year

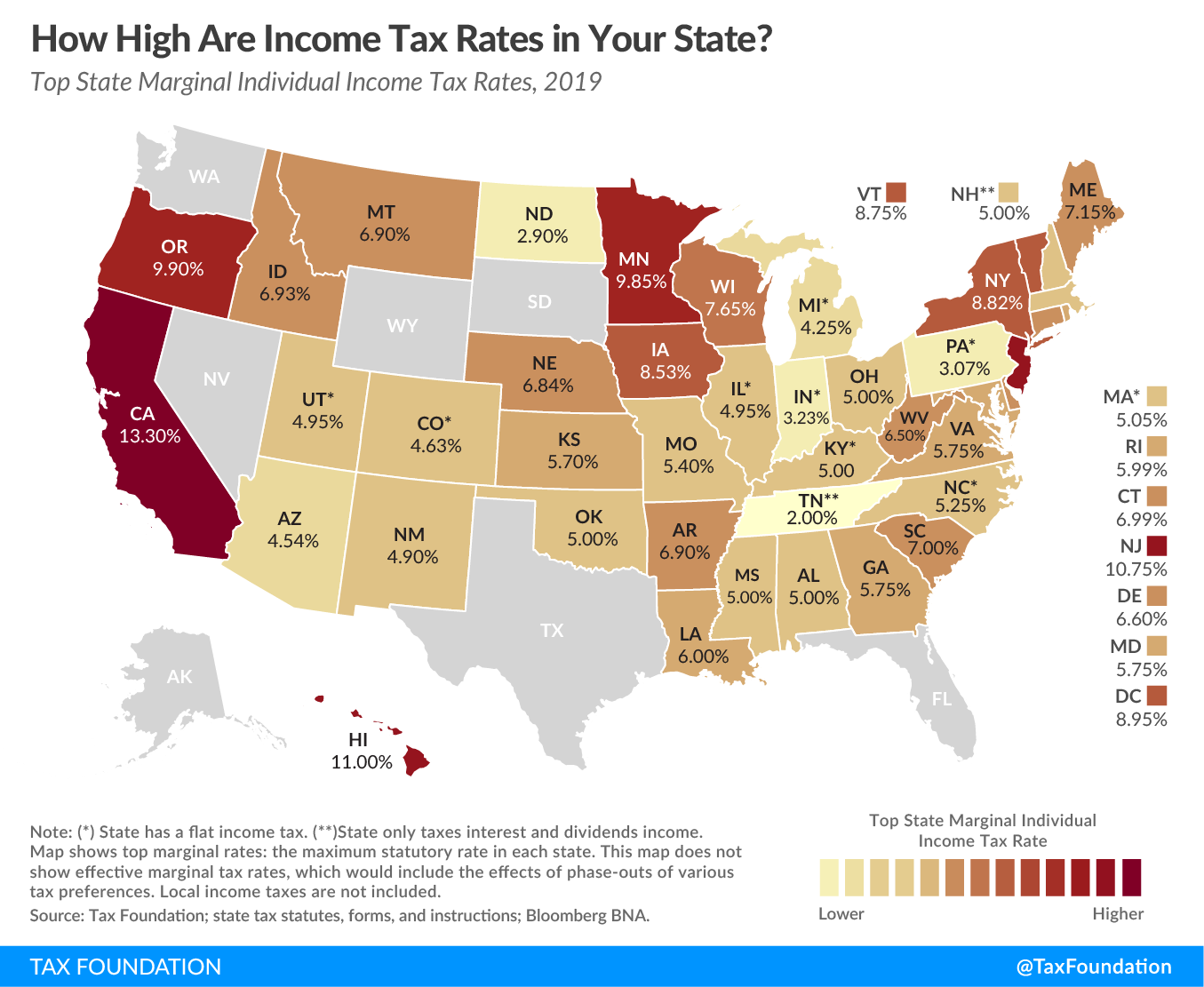

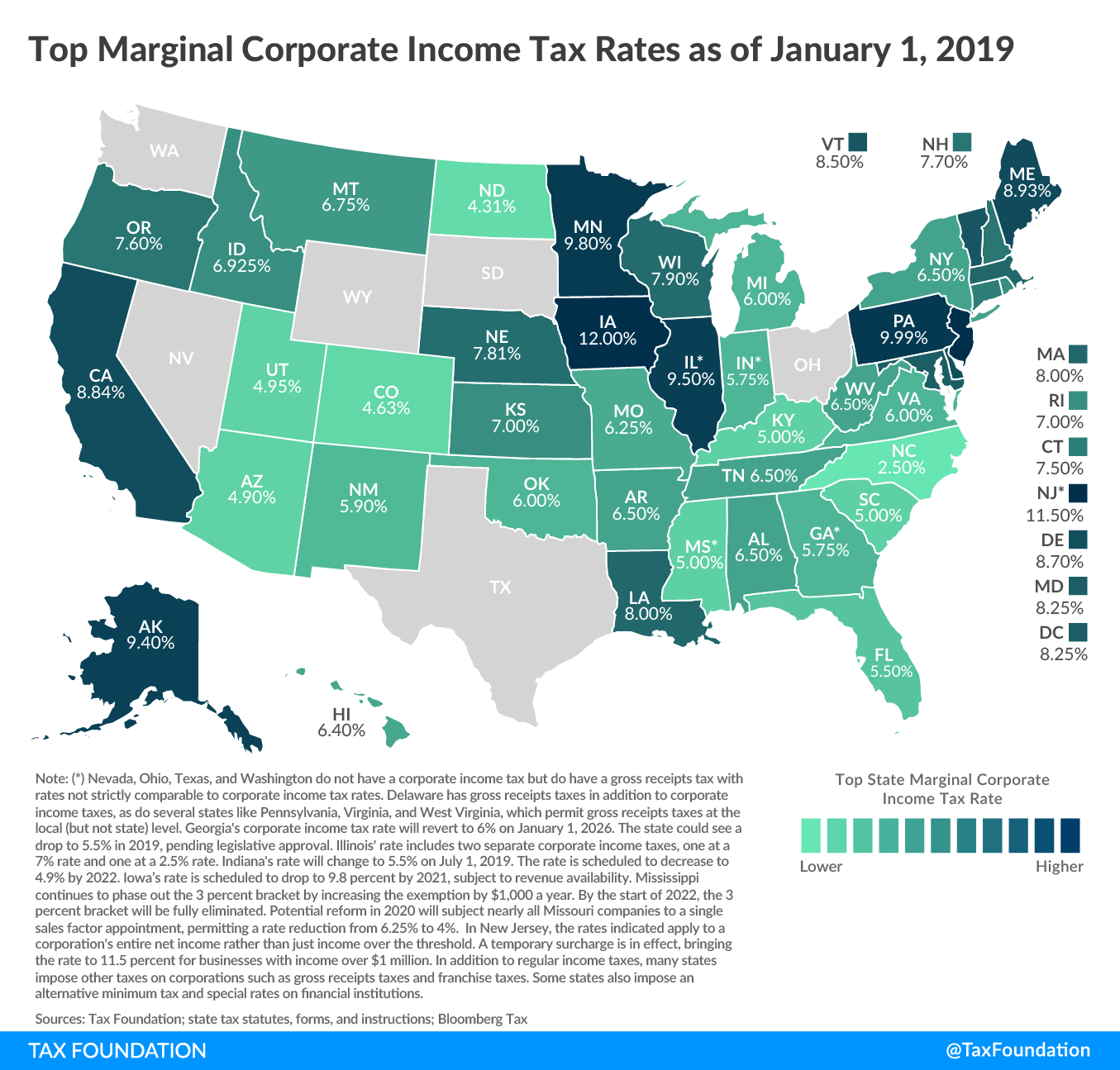

The corporate income tax rate for North Carolina will drop to 30 starting January 2017.

. 4 rows Rate. The total sales tax rate in any given location can be broken down into state county city and special district rates. WAKE COUNTY 160 60 7207 6544 615 6005 6145 578 534 534.

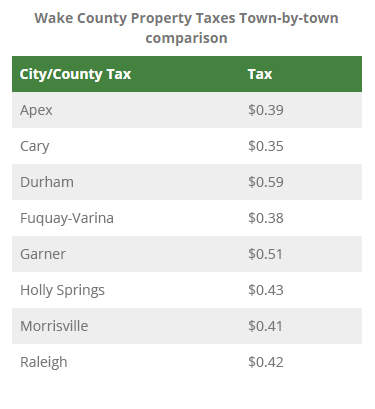

There is not a local corporate income tax. Wake County has one of the highest median property taxes in the United States and is ranked 571st of the 3143. North Carolina has a 475 sales tax and Wake County collects an additional 2 so the minimum sales tax rate in Wake County is 675 not including any city or special district taxes.

This is the total of state and county sales tax rates. APEX 39 38 415 415 38 38 39. Yearly median tax in Wake County.

The Wake County sales tax rate is. Wake County Sales Tax Rate 2019 Coupons Promo Codes 11-2021. The North Carolina state sales tax rate is currently.

And local sales tax rates over the past two years including 10 with increases in the first half of 2019. FY2018-19 Property Tax Rate per 100 Value 06544 2018Q4 Licensed Child Care Facilities 503 FY2017-18 Annual Taxable Retail Sales mil 182737 2018Q4 Licensed Child Care Enrollment 26530 2019 Tier designation 3. 6 rows The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina.

85 x 7027 5973 estimated annual tax. On July 1 2011 Announcements Leave a comment Leave a Reply Cancel reply. Wake County collects on average 081 of a propertys assessed fair market value as property tax.

The state will phase-in a single sales factor in the 2016 and 2017 tax years with a 100 sales factor imposed in the 2018 tax year. North Carolina has a 475 sales tax and Wake County collects an additional 2 so the minimum sales tax rate in Wake County is 675 not including any city or special district taxesTax Rates By City in Wake County North Carolina. Historical County Sales and Use Tax Rates Effective Dates of Local Sales and Use Tax Rates in North Carolina Counties as of April 1 2019 Effective Dates of Local Sales and Use Tax Rates in North Carolina Counties as of April 1 2019.

The minimum combined 2022 sales tax rate for Wake County North Carolina is. Walk-ins and appointment information. Nc sales tax rate wake county.

That makes the countys average effective property tax rate 088. County Profile Wake County NC December 2019 Demographics Population Growth Population Annual Growth 2017 Est Population 1023811 25 2010 Census Total Population 900993 44 Jul2018 NC Certified Population Estimate 1070197 UrbanRural Representation UrbanRural Percent 2010 Census Total Population. Within one year of surrendering the license plates the owner must present the following to the county tax office.

GET THE LATEST INFORMATION Most Service Centers are now open to the public for walk-in traffic on a limited schedule. Any municipal vehicle tax assessed in accordance with NC General Statute 20-97 is not subject to proration or refund. 6 rows The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina.

Wake County North Carolina Mon 14 Oct 2019 - 429 PM ET The countys AAA Issuer Default Rating IDR and GO rating reflect its strong revenue growth prospects ample reserves and broad budgetary tools along with solid expenditure flexibility and. Proof of plate surrender to NCDMV DMV Form FS20 Copy of the Bill of Sale or the new states registration. This table shows the total sales tax rates for all cities and towns in Wake.

The 725 sales tax rate in Wake Forest consists of 475 North Carolina state sales. The 2018 United States. Nearly all of these increases stemmed from ballot measures though local government officials in Wake County North Carolina of which Raleigh.

Wake County collects on average 081 of a propertys assessed fair market value as property tax. Appointments are recommended and walk-ins are first come first serve. Pamlico County Tax Rates County.

TAXING UNIT 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012. The corporate income tax rate for North Carolina is 40. The median property tax in Wake County North Carolina is 1793 per year for a home worth the median value of 222300.

ANGIER 253 53 53 53 53 53 53 53 53 53. NC Sales Tax Rate returns to 675 in Wake County today July 1 2011. The Wake County North Carolina Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Wake County North Carolina in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Wake County North Carolina.

3 rows Sales Tax Breakdown. 3 rows Sales Tax Breakdown.

Taxes Cary Economic Development

Taxes Cary Economic Development

Taxes Cary Economic Development

North Carolina Sales Tax Guide And Calculator 2022 Taxjar

Taxes Cary Economic Development

North Carolina Income Tax Calculator Smartasset

B H Effectively Cancels Out Internet Sales Tax In Us With Its New Payboo Credit Card Digital Photography Review

Taxes Cary Economic Development

/cloudfront-us-east-1.images.arcpublishing.com/gray/3XIVRXMUTZKM5IKLN64GAPWXAU.jpg)

61 Year Old Restaurant Owner Accused Of Embezzling More Than 90k In N C Sales Tax

Wake County North Carolina Property Tax Rates 2020 Tax Year

John A Torbett Johntorbett Twitter

North Carolina Income Tax Calculator Smartasset

/cloudfront-us-east-1.images.arcpublishing.com/gray/3XIVRXMUTZKM5IKLN64GAPWXAU.jpg)

61 Year Old Restaurant Owner Accused Of Embezzling More Than 90k In N C Sales Tax

B H Effectively Cancels Out Internet Sales Tax In Us With Its New Payboo Credit Card Digital Photography Review